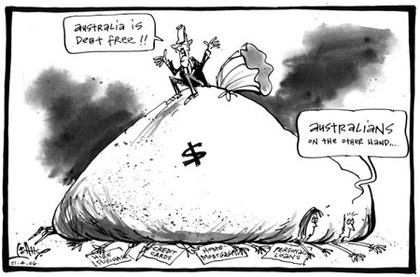

"If only state governments would stop borrowing money for infrastructure, aspirational Australians could get on with what's really important - borrowing for housing speculation and using their credit cards to buy flat screen TVs and $3000 barbeques."

That is not a direct quote from the Treasurer, Peter Costello, but it's a reasonable interpretation of his statements to the Financial Review and the ABC last month, in which he criticized state governments for using debt to finance infrastructure.

The Commonwealth's argument is that state government borrowing for infrastructure is putting demands on financial markets, and any such demand results in some combination of "crowding out" private sector borrowing and pushing up interest rates.

In terms of the basic economic laws of supply and demand the Treasurer is right; the supply of finance is limited, and, as in any market, higher demand from one quarter results in a combination of reduced supply to others and a higher price.

In terms of values, however, the Treasurer is saying that there is something more virtuous about private debt than public debt: "Four legs good, two legs bad".

That judgement would be defensible if governments were borrowing money for current consumption or for wasteful pork-barrelling, such as roads that go nowhere in marginal electorates. (The Commonwealth's own "Roads to Recovery" program comes to mind.) It would also be defensible if private sector borrowing were being channelled into the nation's productive capacity.

That has not been the case, however. Since the Coalition was elected in 1996, the fastest category of bank borrowing has been to individuals for investment housing at a compound growth rate of 20 percent annually, while borrowing for individual revolving credit, mainly credit cards, has been growing at 16 percent annually. Business borrowing has been running at a more modest 12 percent and governments have been reducing their debt.

|

| Thanks to Sean Leahy |

In short, borrowing by the household sector has been putting pressure on interest rates, and, apart from the genuinely useful investment in new or improved housing, much of that borrowing is for current consumption. A by-product of that consumption is a contribution to our chronic foreign debt problem: our current account deficit is more than $50 billion a year, and that's in a period of record high commodity prices. By now our foreign debt is around $60,000 a household.

If our imports were of industrial equipment, which would eventually contribute to our export capacity, then we could be relaxed about our current account deficit, but only about a quarter of our merchandise imports are of capital nature. The rest are either for consumption (clothes, furniture, cars, electronic equipment), or intermediate inputs for eventual consumption (metals, car components, industrial chemicals).

One reason for our current account deficit is that Australia is up against supply constraints. We are paying the price for years of under-investment in skills and infrastructure. That is the irony behind the Treasurer's comments, because he is criticizing the very policies which can ease those constraints. Our prosperity has been attained at the expense of running down our capital - our physical infrastructure, our human capital and our environmental capital.

The Treasurer gloats that his Government, unlike those profligate states, has been running a surplus, but there is no virtue in running a financial surplus while allowing our national assets to run down. Like any balance sheet our national balance sheet has two sides: debt is on one side and assets are on the other. We would not think highly of a business which paid out high dividends but failed to keep its assets - its plant and equipment - up to date. We would consider it unwise for someone to build up a bank balance and share portfolio while letting their house go to ruin and depriving their children of an education.

Such statements by the Treasurer are irresponsible, for they make it hard for governments to engage in responsible borrowing. In New South Wales and Victoria, for example, privately financed toll roads are costing the residents of those states hundreds of millions more than they would be paying had those projects been financed through government debt. Privatization of electricity in South Australia and Victoria has contributed to inflation in power bills. (Just last week, private energy companies complained to the Energy Reform Implementation Group that publicly-owned utilities in New South Wales and Queensland are competing unfairly, because they have access to government finance which is much cheaper than private finance. They seem to have forgotten that access to low cost finance is one of the main reasons for public ownership of large and capital-intensive natural monopolies.)

Australians in 2006 owe their prosperity to a number of factors. These include the economic reforms of the 1980s, the productivity improvements associated with information technology, and growth in China, resulting in high demand for our minerals and the availability of low-cost consumer goods. These have virtually nothing to do with the policies of the Commonwealth Government.

The Government has squandered this prosperity; rather than re-investing in our long-term productive capacity and building up our resilience to cope with future shocks and the end of the resource boom, it has wasted public revenue on corporate and middle-class welfare, and has distorted the tax system so as to reward speculation over productive investment.

At the same time it has promulgated the idea that government debt is bad, even if it is used to finance productive public assets, while household debt is OK, even if it is spent on consumption.

Worse, perhaps, it has come to believe in its own competence - helped, to a large extent, by an Opposition which has failed to engage the electorate with an alternative and more responsible economic vision.