Economics

Trends in wellbeing – generally OK, but some worrying signs

HILDA is the acronym for the Melbourne Institute’s study “Household, Income and Labour Dynamics in Australia” project. Unlike most studies that take a snapshot of our wellbeing at one point in time, or those that derive trends from sampling the population at different time points, HILDA is a longitudinal study, looking at what happens to the same representative cohort of people over an extended period.

The difference between normal time series (such as those conducted by the ABS) and longitudinal studies as conducted by HILDA is crucial. A normal time series study, for example, may reveal that between last year and this year the percentage of people who are unemployed has remained pretty well constant. But we don’t know whether this is because the people who are unemployed now are the same people who were unemployed last year, or if there is a degree of turnover – perhaps most of the people who were unemployed last year are now employed. That’s where longitudinal studies such as HILDA play an important part in guiding policymakers.

The latest HILDA report covering the period 2001 to 2019 was released last Tuesday. It reveals a society doing reasonably well on most indicators of wellbeing, but there are indicators of distress.

While real incomes have generally risen and fewer people are reporting financial difficulties, there are significant regional differences: Australians living in big cities have done better than those living in the country for example.

Contrary to some widely-held beliefs, income distribution hasn’t changed much, but inequality is becoming a more enduring problem. The same people who were at the bottom, middle or top of the distribution last year, or n years ago, tend to remain in the bottom, middle, or top of the distribution this year. There is less mobility up and down than there used to be, meaning our income distribution is becoming more entrenched. This should be of concern to policymakers: short-term inequality is a driver of successful market capitalism; long-term inequality, which generally results from structural weaknesses in the economy, is a driver of resentment and a Trumpian revolt against the elites.

One disturbing finding is that a growing proportion of younger people are disengaged: they are not studying, working, or looking for work. A few have caring responsibilities keeping them out of the paid workforce, but many, disproportionately male, and disproportionately from low-income households, are not engaged in anyeconomic activity. HILDA simply presents the findings, but this finding has implications for a raft of policies to do with community safety, political extremism, health care, and social security support, to name a few.

Another finding is a growing number of people reporting psychological distress. More women than men are reporting lessening social interaction and increasing psychological distress, but men and young people are significantly over-represented in the categories of most severe psychological distress associated with depression and a sense of worthlessness.

A finding that has captured a great deal of media attention is that people end up parenting fewer children than they had intended when they first married or formed an enduring relationship. The common interpretation is that it’s a sign of financial stress suffered by young families. But maybe it’s simply that people learn from experience that parenting is hard work.

One unsurprising finding is that our attitudes to what some may call traditional “family values” are liberalising. We are becoming more accepting of same-sex relationships, divorce, cohabitation without marriage, and more relaxed about changing gender roles. One statement that made its way into this part of the survey is “On the whole, men make better political leaders than women do”. Men and women are making good progress on that one, but there is still a predictable gender difference.

While we may be expressing more liberal values around gender roles. there is evidence of enduring patterns of behaviour around the division of unpaid work. Two pictures, taken in kitchens, tell the story: on page 96 is a picture of a woman, with a child on one hip, stirring a pan on a hotplate while another slightly older child is standing dangerously close to the stove; on the following page is a picture of man at a kitchen sink, holding a dog, apparently wondering if he can economise on housework by doing the dog and the dishes as one batch.

This HILDA survey takes us up to 2019. For the most part it reveals slow but significant changes in social and economic conditions. The next survey will cover the pandemic years. That will almost certainly reveal some significant discontinuities.

Trends in inheritances

The Productivity Commission has published a staff research paper Wealth transfers and their economic effects. It’s mainly about what people give to their kids, either as gifts during their lifetimes, or as inheritances when they die.

It confirms that disparities in wealth are more enduring than disparities in income (even though most public policy concern is about income). Wealth tends to get passed on from generation to generation.

But contrary to the view that “the bank of mum and dad” makes it easy for kids in well-off families to get into housing, the Commission finds that children generally have to wait until their parents die to get their hands on that wealth. The inheritance comes when the children are in their 50s. Perhaps a few generations back the inheritance came when people really needed it, but with extended live spans the inheritance comes around the time when the financial burdens of child-rearing are easing. That is hardly the best way to spread people’s financial resources over a lifetime.

The researchers find that wealth transfers, although growing, are not in themselves contributing to widening wealth disparities (they explain the arithmetic in simple terms), but they do contribute to the persistence of wealth disparities, although not to the same extent as in the USA. In other words they are part of the story of decreasing intergenerational mobility.

The ABC’s Breakfast program last Tuesday has a combined session in which the Productivity Commission’s Catherine de Fontenay discusses the findings of the report, and Roger Wilkins of the University of Melbourne discusses the findings of HILDA’s longitudinal study, released on the same day. (See the entry above) There is some similarity in their findings, particularly in relation to the persistence of disparities, and the Productivity Commission staff work closely with HILDA researchers, but it should be noted that while this recent work by the Commission is about wealth, the HILDA work is mainly (but not exclusively) about income. (14 minutes)

We cannot afford those tax cuts

Both the Coalition and Labor are promising significant tax cuts for Australians with high incomes, with the full effect to be realised in 2024-25.[1]

ACOSS has called for a guarantee from all parties that instead of tax cuts, they will raise the revenue to provide public services necessary to ensure our wellbeing as we emerge from the stress of dealing with Covid-19. Among the services they mention are income support, housing, health care, employment services, and infrastructure.

Even though Australia has close to the lowest taxes of all high-income “developed” countries the fiscal approach adopted by the Commonwealth is to set a ceiling on Commonwealth taxes – 23.9 percent of GDP – a figure with no more economic justification than Douglas Adams’ 42 in The hitchhiker’s guide to the galaxy. This is in spite of the established need, known as the Baumol effect, for increasing outlays on public services as an economy grows, because most public services such as health care, education, and community safety are intrinsically labour-intensive and cannot enjoy the productivity gains of goods traded in the private sector.

ACOSS’s call is a reasonable request for the Commonwealth to shift its thinking. Rather than setting a taxation cap and trying to squeeze public services within that cap (therefore deliberately leaving many economically-justified services unfunded), it is calling for the government to start by considering economically justified needs, and then adjusting its revenue to meet those needs.

[1] Details in the Australia Institute document The distribution of the Government’s stage 3(a) tax cuts. ↩

Our reserved Reserve Bank

Even though our exchange rate is as low as it has been for many years, house prices are still rising and inflationary pressures are accumulating in most countries, the Reserve Bank on Tuesday opted to leave the cash rate at 0.10 percent, and to continue its program of purchasing bonds.

It clearly intends to do nothing about house price inflation. Nor does it intend to act in anticipation of general inflation. Its statement concludes:

The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. This will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently. This is likely to take some time and the Board is prepared to be patient.

When will it have no choice but to raise interest rates?

Why you will have to pay more for your next Porsche

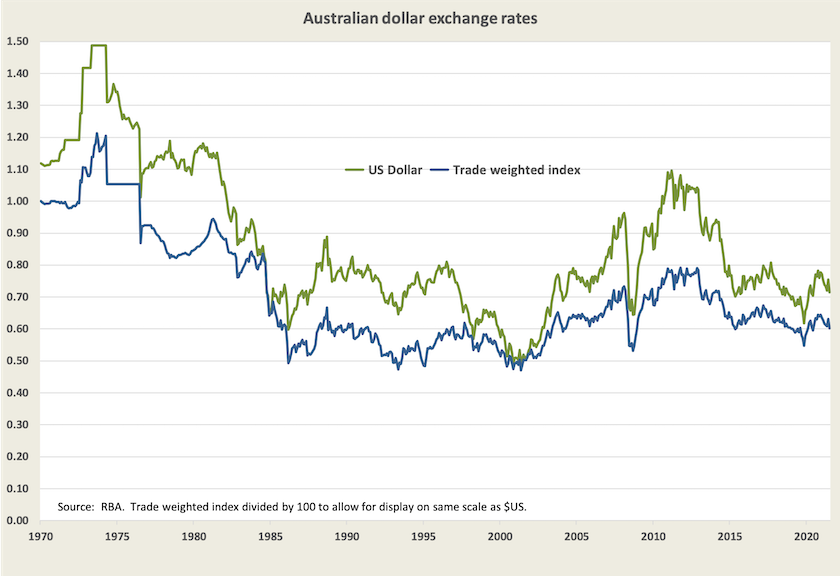

Perhaps while we have been confined to our country girt by sea we haven’t noticed how much the Australian dollar has fallen over the last few years. Ten years ago an Australian dollar bought you $US1.10; now it buys you just $US0.70. When we start travelling again we will be in for some rude shocks.

There are two reasons for the fall in the Australian dollar. In the short-term it is because the Reserve Bank is deliberately keeping official interest rates low, and will do so until there are signs of inflation, even while interest rates rise in other countries. People looking for somewhere to park a few billion in spare cash go for a country with higher interest rates. The other reason, in the medium term, is because our currency is closely linked to the commodity cycle. As iron ore prices have fallen, so too has the Australian dollar, as explained by David Taylor on the ABC website: How the falling Australian dollar could affect interest rates.

The gist of his article, which follows established economic lines, is that a low value of the Australia dollar, at some time will show up in higher prices for imports. We will have to pay more for our Porsches or holidays in Bali, depending on our means and tastes. Those high prices will give a boost to inflation, and in response the Reserve Bank will finally have to push up interest rates. (See the article above.) We might wonder why those prices haven’t already risen, but in the recovery phase of a recession companies tend to hold off on price rises until there is a recovery in demand.

Taylor’s article indirectly raises a broader issue, the volatility of our exchange rate as demonstrated by the graph below. It shows the exchange rate against the US dollar (in green) and against the slightly more stable trade-weighted index (which takes into account the $A exchange rate with those countries with which we trade), going back over the last half-century.

In economic theory our low exchange rate, as we are now experiencing, should support the domestic development of trade-exposed industries such as manufacturing, but manufacturing capacity takes years to develop – years in which our exchange rate may rise again in response to the commodity cycle. Investors are therefore wary about making long-term investment commitments in industries that may be wiped out by a rise in exchange rates. As a result our non-mineral exports tend to be confined to industries that can adjust output in a reasonably short period, such as tourism and education services (pandemics permitting).

In the 1980s the Australian economy underwent a period of difficult structural change, guided by the reform policies of the Hawke-Keating government. The $A, previously supported by high tariffs, came down to a more competitive level. But over the subsequent years, under the indulgent policies of the Howard government, we failed to follow through with policies that would reduce our commodity dependence: in fact the Howard government’s changes to capital gains tax actually penalise patient and long-term investment that is required to develop complex industries such as manufacturing.

Consumer economics

One revelation in the September quarter National Accounts, released earlier this month, is that households have built up their savings, particularly in states that have had Covid-19 restrictions.

Following a miserable 2020 Christmas-New Year period, firms in the retail, travel and accommodation industries hope those households can spend up this season.

Not everyone is rolling in cash, however, and many are turning to buy-now-pay-later schemes (BNPL). Financial Counselling Australia has a report It’s credit, it’s causing harm and it needs better safeguards. Financial counsellors are increasingly reporting that BNPL debt is a major problem for their clients. The report finds that “BNPL is too easy to access, leading to people getting overcommitted with multiple accounts”, and for many is used not just for discretionary expenditure, but to cover day-to-day expenses. (Afterpay listed on the ASX in May 2016, for $1.00. Its latest share price is $100.17.)

Another issue that has come to the attention of consumer sleuths is that the Australian Hotels Association, one of Australia’s most successful industry lobbyists, is supporting the Western Australian government’s proposals to impose onerous restrictions on Airbnb and Stayz. Hotels and resorts need individual consumers to subsidise the generous discounts they offer to corporate and government customers.

Vale Geoff Harcourt

On Tuesday one of Australia’s most influential and respected economists, Geoff Harcourt, died at the age of 90.

Over his long professional life, teaching, researching, and advising governments, he influenced the lives and ideas of many Australians involved in public policy, and kept alive the ideas of Keynesian economics. Roy Green of the UTS has a short obituary on the ABC’s program The Money (from 22:11 to the end).

John Hawkins of the University of Canberra and Selwyn Cornish of ANU describe his life and contributions to public policy in a Conversation piece Remembering Geoff Harcourt, the beating heart of Australian economics.

I remember him as the teacher at the University of Adelaide in 1969 who introduced his students to economics as a rigorous but liberal discipline and stimulated in me a lifelong interest in public policy. His passing is a loss to the world of ideas, but I am pleased to know that he outlived the passing fad of neoliberalism.