Other economics

Competition – indicators of price gouging

We’ve been very concerned about supermarkets, but let’s not forget the rest of the economy.

Peter Martin, writing in The Conversation, tells us about evidence compiled by Treasury that throughout the economy there is less competition than there has been in the past, giving firms more opportunity to raise prices.

To get a numerical indicator of the extent of competition, Treasury uses a standard measure, known as the concentration ratio for each industry – the percentage of the market held by the largest firms. One such indicator, the 65 percent of the market held by Coles and Woolworths, has become common knowledge.

The Treasury paper reveals that in most sectors concentration has increased so far this century, that merchants’ mark-ups have risen, and that productivity growth is poorer in more concentrated sectors: that’s all confirmation of standard economic theory. It also finds that wages tend to be lower in more concentrated sectors: this is counter to the idea that workers can extract higher wages from firms enjoying monopoly power. Maybe that was the case when unions had more power, but it isn’t the case now.

Martin’s paper – Worried about price gouging? For banks, there’s a simple solution – focuses on banks, a sector where profits and costs to consumers are high, but are less visible than the prices we pay at supermarkets. Martin believes there is not a great deal governments can do about supermarkets, but he reminds us of an Australia Institute suggestion for the government to offer a low-cost banking service, expanding the functions of de-facto bank accounts we already hold with the Australian Taxation Office. Martin explains:

The primary function of any bank is to provide a numbered account into which Australians can deposit and withdraw funds. The Australian Tax Office does this already, at an incredibly low cost. The tax office gives every working Australian a tax file number. Employers deposit money into these accounts, and – should the tax office owe a refund – taxpayers withdraw them.

Why not expand this low-cost operation into full banking services, including home loans asks Martin.

Radical? Not really.

Until 1991 the Commonwealth Bank was government-owned, and most state governments had state banks. Not only in banking, but also in other sectors – airlines and health insurance – there were government-owned enterprises in competition with private enterprises, keeping the bastards honest in everyday language, or engaged in benchmark competition to use the economists’ terms.

We lost this valuable means of consumer protection in a bipartisan frenzy of privatization, driven by a “small government” ideology, and an obsession with the fiscal cash flows (allowing assets to be sold to fund current requirements). Privatization resulted in a massive transfer from the common wealth to the private sector, through under-priced share placements and IPOs. This was our own version of crony capitalism, a small-scale version of the kleptocracy that established the Russian oligarchy when the Soviet Union collapsed.

Competition – necessary but not sufficient to get prices down

Last week Albanese responded to Nationals Leader David Littleproud’s suggestion that the government could force divestiture of the supermarket duopoly, reminding Littleproud that Australia is “not the Soviet Union”.

When a Labor prime minister has to make such a statement in defence of the market, we know that the political landscape has changed since the days of Menzies’ red scares.

In most regions, particularly non-metropolitan regions, supermarkets are local monopolies. We tend to think of “competition” and “monopoly” as two distinct categories, involving price-takers and price-setters, but as economist Joan Robinson pointed out, the more realistic description of most markets, even when they have many players, is “monopolistic competition”, because firms generally have some capacity to set prices. Think of the time customers invest in learning about which brands suit their tastes, the layout of the shop, the cost of travelling to another supermarket, and so on. Switching is not costless.

Competition regulators try to reduce firms’ power to set prices, to tip the balance back towards the consumer, but there is no one accepted means of doing this.

Anyone tuned into the ABC last Thursday would have heard two views on competition, one by Andrew Leigh, Assistant Minister for Competition and Treasury – “Vital we boost competition” – and the other by former ACCC chair Graeme Samuel -- Competition watchdog defends ANZ decision. While Leigh was talking specifically about supermarkets, Samuel was talking about ANZ Bank’s takeover of Suncorp, mentioning supermarkets only at the end.

Importantly, Leigh was arguing for more competition while Samuel was arguing that in banking, another sector with high concentration, there was no need to protect against further concentration. It’s a pity the ABC didn’t put them on together, because it would have been a civilized argument between two people, both concerned with consumer welfare and both well learned in economics, and with different (defensible) views on the effectiveness of opening up markets to more competitors.

The main economic point, on which both would surely agree, is that having more players in a market, or more opportunity for players to enter a market, may be a necessary condition for lower prices, but it is not a sufficient condition. Concentration ratios, such as the 65 percent market share held by Coles and Woolworths, are informative but on their own they don’t tell us much. If Coles owned all the supermarkets in Victoria and Woolworths owned all the supermarkets in New South Wales (a situation not unlike the state monopolies once given to breweries), the concentration would still be 65 percent.

Another indication of consumer detriment can be an enduring stream of high profits in an industry. They may be high by historical standards or in comparison with other industries with a similar risk profile. But, as pointed out in previous roundups, there is only weak evidence that the two large supermarket giants are making excess profits. There is an informative 2018 paper by Jonathan Hambur and Gianni La Cava of the Reserve Bank Business Concentration and Mark-ups in the Retail Trade Sector. Its data is dated, but the authors find that concentration figures alone do not reveal much about the likelihood of consumers being ripped off.

The idea that simply having more players in the market will achieve competitive outcomes comes from economics textbooks that model situations where there are many firms competing on price. In such ideal situations Adam Smith’s invisible hand is at work, bringing consumers the benefits of choice and low prices.

But what if firms compete with one another on some basis other than price? What happens in a duopoly when firms are competing on market share, and spend massively on advertising (or force their suppliers to spend on advertising) in order to hold their share? Or perhaps they carry too many items as a means of holding fussy customers – note the comparative lack of variety on Aldi’s shelves. Non-price competition can raise prices, without necessarily contributing to profits.

Also profit, we should remember, is a figure net of expenses. We should other questions. How much are executives paid? In this regard many people were shocked by Woolworth’s departing CEO Brad Banducci’s likely payout of $24 million. Do they own their buildings or are they renting them? If they are renting is it in an arm’s length transaction or are they siphoning off their profits to a related entity? Are supermarkets being heavied by shopping centre owners? There are many ways firms can operate that benefit neither customers nor shareholders.

That is why inquiries into supermarkets have to go beyond simple measures of concentration and profits, important as they are, and to look forensically at firms’ business practices.

Working from home – as a sociologist from Mars would see it

A sociologist from another planet, having made a visit to Earth, would report on inexplicably strange and dysfunctional behaviour among a class of earthlings in the administrative ranks. They have comfortable homes, well-equipped with technology, but each day they leave their homes empty, and join long queues to move to other places, often cramped and noisy, to use the same technology.

The sociologist’s report would contrast this urban absurdity with the much more functional arrangement among farmers, for example, who do not engage in such wasteful practices.

Writing in The Conversation the earth-bound Leonora Risse of the University of Canberra notes that Working from home is producing economic benefits return-to-office rules would quash. Her findings about people who spend some hours working from home, disaggregated by occupation and industry, align with general impressions. For example between 2019 and 2022 (before and after the pandemic) there was a huge rise in working from home – from 19 percent to 42 percent – among “clerical and administrative workers”, and a rise from 40 percent to 85 percent in the “financial and insurance services” industry.

Her article focuses on the benefits of working from home in terms of making it easier for people to enter the workplace, particularly women with young children. There are also benefits in terms of utilization of infrastructure: the sociologist from Mars would be puzzled to see the huge effort in putting extra lanes on roads, congested on one side, under-utilized on the other, all to switch a few hours later.

There are indeed disadvantages when people are isolated from fellow workers. While there is a lot of hype about teamwork, unnoticed are the small acts that boost productivity – advice on using software, testing ideas and so on. And when it comes to recognition, it is personally costly to be out-of-sight-out-of mind. For those reasons the model that seems to be most satisfactory all around seems to be a hybrid one.

The reasons for calling people back to the office are not always articulated. Middle management positions tend to attract people harbouring deep insecurities, who draw personal comfort from being surrounded by “subordinates”. But, as a short paper by PWC suggests, the main reason is simply that office workplace became the norm: “Back to the office” proving easier said than done. Many organizational practices endure long past the time they become redundant or dysfunctional.

One benefit of working from home, not always articulated, is that it reduces people’s dependency on the “employer” to provide the tools of trade, providing more incentive for people to take personal responsibility for their outlays. Yet the outgoing Tax Commissioner Chris Jordan, expressing a personal opinion, has suggested that there would be benefits in getting rid of tax deductions for work-related expenses. He’s surely unaware of the paternalism in such an idea – that “employers” are responsible people who spend money wisely, but “employees” are irresponsible, wasteful and liable to cheat. Australians love their work-related deduction he states: could it be that they love them because they are an aspect of the autonomy and agency that is denied to them in workplaces?

By most historical accounts, the Black Death brought about a significant re-alignment in the power relationships in people’s working arrangements. Fortunately the Covid-19 pandemic has been less destructive, but it has had its own, and still not fully recognized, changes.

ABS reports Australia to be in a deflationary death spiral

The ABS Consumer Price Indicator, released on Wednesday, shows that Australia is now in a death spiral of deflation.

In January 2024 the CPI Index Number was 121.8, having fallen from 122.2 in December 2023. Annualized, that’s deflation of 3.9 percent, something we haven’t seen since the 1930s Depression.

OK – enough of that interpretation. The figures and arithmetic are right, but the argument is wrong, because there are margins of error in the index numbers, and there is no seasonal adjustment – does the fall result from post-Christmas bargain sales, for example?

I use this obviously shonky example to urge caution in interpreting categorical statements such as “Inflation in January was 3.4 percent” that appeared in some media. All we know is that a chosen set of consumer prices, as indicated by an ABS sampling technique that involves a margin of error, rose by 3.4 percent between January 2023 and January 2024. That probably understates what CPI inflation has been in January, because we know it was higher a year ago. In fact we really don’t know what inflation was in January.

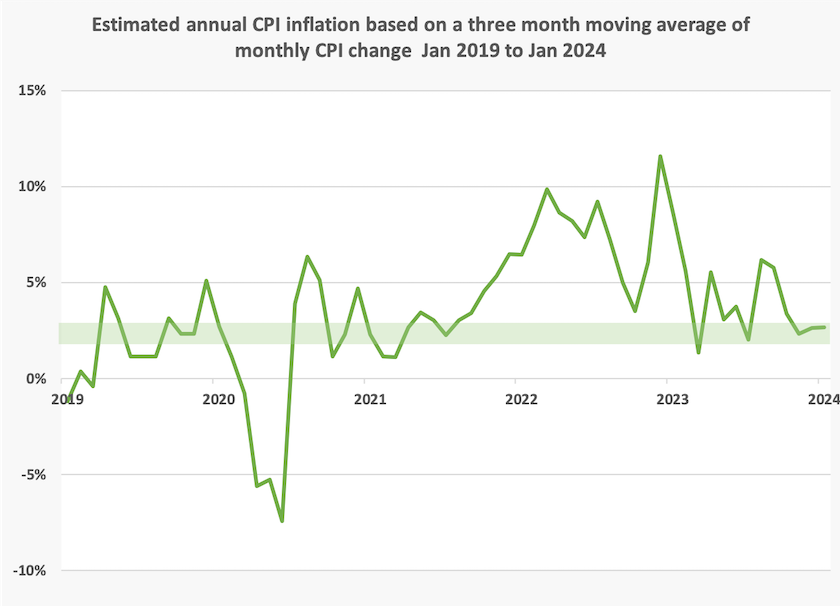

As a compromise between being too influenced by month-to-month noise, and using too long a time period, I have plotted the moving average over three months, shown below. The graph is still fairly noisy, but it indicates a definite downward trend, perhaps flattening a little. The pale green area is the RBA’s two to three percent comfort zone, and at a figure of 2.7 percent, the figure for January, it looks as if we may be in in that band. But it would be rash to suggest there is precision in this number, or in the 12-month number grabbed on by most journalists.

You can go to the ABS website, linked above, for a more complete explanation, or to Michael Janda’s explanation on the ABC website: Inflation steady in January, below economist expectations of a bounce. Janda points out that prices of items most people would consider to be “non discretionary” or “essential’ are rising somewhat faster than prices of other items, suggesting that households may still be a little more stretched than is suggested by any headline figure.