Other economics

How to fix capitalism in Australia

It would be pointless to place University of London professor Mariana Mazzucato on any left-right spectrum.

She’s a passionate advocate for the “entrepreneurial state”, a government that is active in fostering innovation and economic growth. This is in stark contrast to the “small government” movement that has shaped public policy in Australia for the last 30 years, and goes well beyond the idea of government having a role only when markets perform poorly or fail.

She is also a passionate believer in the power of market mechanisms – the use of prices to allocate resources, and the power of rewarding risk-takers and entrepreneurs for making value-adding investments. She sees a problem as public budgets are increasingly consumed by transfer payments to compensate for the failure of economies to achieve a fair and just distribution of benefits. That demand for social security payments detracts from governments’ capacity to provide the hard and soft investments that would improve economic performance. The irony is that neoliberalism has required the expansion of the redistributive state. (This was an emphasis in Miriam Lyons and my 2015 book Governomics: can we afford small government?)

We gain some insight into Mazzucato’s economic ideas in an interview with The Saturday Paper editor Emily Barrett: How to fix capitalism. To quote:

I’ve criticised left-wing and progressive governments for being too able and capable to talk about redistribution and not very able and capable to talk about value creation. You’re never going to win the battle as a government to get the policies right if all you know how to talk about is redistribution. You need to know how to govern production.

In that same interview she calls on our government not to bind itself with a fear of public debt, remarking that Australia has very low public debt and has an immense untapped opportunity for public investment to grow our economy. She also has some comments on “the consultification of government”, which has weakened the capacity of our public service.

Barrett managed to interview Mazzucato on the eve of her speaking tour in Australia, a tour hosted by the CSIRO, the Commonwealth Department of Industry, Science and Resources and Breakthrough Victoria. Unfortunately although the CSIRO and the Department of Industry are funded by taxes, they have not put these lectures in their websites. but you can hear her delivering the Commonwealth Bank 2021 State of the Nation Address, and a CEDA-hosted address in 2018 during an earlier visit to Australia. She is well-acquainted with Australia’s economic policies, opportunities and problems.

Barrett’s interview is behind the Saturday Paper paywall. But you can get a good idea of her advice for Australia in an ABC The Business interview What big economic ideas is Jim Chalmers considering for the 2024 budget?, which follows her session with Treasurer Chalmers (12 minutes). Her vision for re-invigorating Australia’s de-industrialized economy is centred on investing in our energy transformation, a transformation that goes well beyond the energy sector itself and sees us “doing everything differently”.

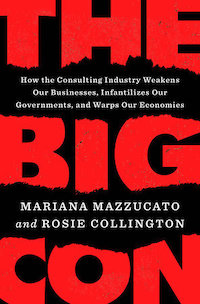

Her most recent book, of particular relevance to Australia, is The big con: how the consulting industry weakens our businesses, infantilizes our governments, and warps our economies, co-authored with Rosie Collington. You can find references to her other books and publications, including many reports available for download, on her website.

If you’re looking to rent, move to Melbourne, even if you loathe football

The media has given some attention to the PropTrack’s Rental affordability report, which shows that rental affordability has reached its worst level in the 17 years that PropTrack has been keeping records.

It’s an informative document, because it is based on advertised rents, while the ABS in its CPI series covers both new and ongoing rents. Although some property owners hit their customers with high increases, most wait until a property is vacant before they increase rents substantially. PropTrack therefore gives a clearer (and more depressing) picture for those seeking to rent, while the ABS covers all people in the rental market including those who are comfortably settled. Even so, PropTrack may still be understating the problem, because some rentals are negotiated at prices higher than those advertised.

The rise in rental unaffordability has been particularly strong since 2022. Over 2022 and 2023 median advertised rents rose by about 50 percent – from $400 a week to $600 a week in round numbers. Of even more concern is that rent rises have been highest at the bottom end of the market.

PropTrack does not speculate on reasons for this rapid movement, but it is consistent with a surge in demand as a Covid-era backlog in immigration was cleared, and as tenants started moving around again. It is also probable that the recent rise in interest rates is having an effect on the rental market.

In an article on Westpac’s IQ magazine – The slow lane in the tunnel – the bank’s chief economist and former RBA assistant governor, Luci Ellis, provides some interpretations on the recently-released national accounts. She includes an observation on housing:

New housing construction is one of the most important channels of the transmission of monetary policy, here and overseas. The current low rate of dwelling investment is therefore an expected outcome of the RBA’s policy actions. To the extent that higher interest rates have dampened dwelling investment, however, they exacerbate Australia’s current housing affordability challenges in the medium term.

Changes in housing construction resulting from interest rate rises take some time to flow through to the rental market, but there may be a more direct effect because of the impact of interest rate changes on highly-indebted property “investors”.

Yahoo Finance has a sob story about a landlord who is being forced to sell four properties. The final burden on this unfortunate fellow is a rise in the Victorian government’s land tax, but the general problem about which the journalist Stewart Perrie is writing is the burden of interest rates. He points out that those property owners pushing up their rents aren’t avaricious landlords. Rather they are “mum and dad” investors who have saved for their retirement and who now find they are taking a loss on their investment properties.

A trap for naive investors

Maybe property owners are doing it hard. But how is it that unsophisticated investors are borrowing money to invest? The government has specific rules, designed to protect people from their own unwise decisions, imposing tight limits on borrowing by self-managed superannuation funds, but what people do with their non-superannuation savings is their own business. In fact the “negative gearing” tax break actually adds to the attraction of borrowing to invest.

Any financial adviser with a concern for his or her clients, and who understands the history of financial speculation, would discourage unsophisticated investors from getting into leveraged investments. Leveraged investments are disproportionately affected by asset price and interest rate movements: that’s what “leverage” is all about. It’s a bonanza when all is going well, and a disaster when the financial tides turn.

It’s hard to feel sorry for those who have been sucked into the world of financial speculation and have treated housing with the same indifference as they might treat Bitcoin or pork belly futures. But the innocent victims are renters. And as over-committed speculators are forced to sell their properties, home buyers could benefit, resulting in even fewer properties available for rent.

It’s notable from the PropTrack report that there are significant regional variations in rental affordability. For now, Victoria is the most affordable market while New South Wales is the least affordable, but these rankings move around in time, and the trend in rental prices is still upwards.

While it acknowledges the need for a long-term supply approach, PropTrack calls for more rent assistance for those struggling. It is hardly surprising that a business primarily serving the real-estate market should be in favour of such support, but that doesn’t mean its recommendations should be dismissed. Even if supply were to catch up with demand, there would still be many people unable to pay market rents for anything liveable.

Brendan Coates and Joey Moloney of the Grattan Institute stress this ongoing need for rental assistance in their Conversation article Let’s not kid ourselves that private investors or super funds will build the social housing we need.

If you seek value from your taxes, move to Perth, even if you don’t like hot summers

In comparison with most other federations, Australia is reasonably free of sharp economic disparities between states. There are differences, but we have nothing like the differences between Massachusetts and Mississippi in the USA, or between Bayern and Thüringen in Germany.

One reason is that most taxes in Australia are collected by the federal government, which runs almost all social security programs, including age pensions and unemployment benefits, and programs such as Medicare and the NDIS.

Another is that, in a convention that goes back almost 100 years, our federal government distributes funds to state governments in accordance with a principle known as “fiscal equalization”.

Rather than being distributed on a simple state population basis, funds are distributed on a basis that provides each government the capacity to provide the same level of public services. The Commonwealth, through the Grants Commission – a body established in 1933 – calculates different states’ needs based on factors such as geography and demography, considers those states’ capacity to raise their own taxes, and adjusts the per-capita distribution accordingly. Because states provide so many important services, including school education, policing, hospitals and roads, this gives all states and territories the capacity to provide an equal standard of government services.

Over time this has been manifest in a transfer of tax revenue between states, most significantly from taxpayers in New South Wales and Victoria, to Tasmania and the Northern Territory. This has always been an issue between state premiers, but for most people it is unnoticed. The process has a long history, with many changes and tweaks, but it now determines how funds collected through GST are handed back to the states. If you live in New South Wales or Victoria, for example, only about 90 cents in each dollar you spend on GST comes back to you, while people in smaller states with higher needs, such as South Australia or Tasmania, may get back, say, 140 cents, for each dollar they spend on GST.

That process has generally been free of partisan political interference, until 2018, when then-Treasurer Scott Morrison made a special deal to top-up Western Australia’s share of GST revenue, overriding the Grants Commission formulae, and in order to stave off a revolt from state premiers, he promised that no state would be worse off.

Why was Western Australia so privileged? In part it was because at that time its revenue from mining was down, and in part because the Coalition held 11 of the state’s 16 seats, some of which were on tight margins. Saul Eslake has a description of the deal in an article in Austtaxpolicy: Western Australia’s GST deal: the worst Australian public policy decision of the 21st century thus far.

Grace Burmas, an ABC journalist based in Perth, wrote in February about the politics of the deal in an article WA's GST share unfair given iron ore price say economists, as Rita Saffioti [the state treasurer] warns of political risk. That political risk this time is for Labor, which in the 2022 election won 4 seats from the Coalition (another went to independent Kate Chaney).

The Commonwealth government has extended the deal. On the ABC’s Breakfast program, in a ten-minute discussion of fiscal matters, economist Chris Richardson explains the deal’s cost in terms that should make sense to taxpayers: WA wins from GST carve up. To quote Richardson:

Every taxpayer in Australia has to pay the first $400 of their tax every year basically to support a marginal seat strategy in Western Australia. It’s a ridiculous outcome.

It’s a bipartisan ridiculous outcome, which means it tends to be self-perpetuating. It’s costly, not just for the 23 million Australians who don’t live in Western Australia, but also for the Commonwealth budget because of the top-up provisions to ensure no state is worse off, which Richardson estimates will cost the Commonwealth budget $5 billion a year.

The Grants Commission has a paper on what a GST distribution would look like if the Commonwealth had not intervened. Western Australia, by far the fiscally wealthiest state because of mining taxes and royalties, would get back 75 cents in the dollar, New South Wales and Victoria 87 cents and 97 cents respectively, while the big beneficiaries would be the Northern Territory (506 cents) and Tasmania (182 cents). Strangely the ACT does well – 120 cents. Could this have something to do with the Grants Commission, which obviously uses objective means to calculate relativities, being located in Canberra?

As Michael West Media explains, the Western Australian deal isn’t the only issue in the distribution of GST revenue. Their article NSW, Queensland biggest losers in ‘absurd’ GST carve-up explains that royalties from coal mining feature strongly in the Grants Commission formulas on states’ capacity to raise their own revenue. In terms of fiscal incentives that must surely be considered poor public policy when the nation is committed to a zero carbon path. (It’s not the only such incidence of a similar perverse incentive: the Commission similarly punishes states that do not raise enough money from gambling taxes.) As Sydney-based ABC journalist Isobel Roe explains, the New South Wales government isn’t very happy about the way GST revenues are carved up.

But for now the main issue is the bipartisan interference in the Grants Commission process, which raises the political salience of Commonwealth-state fiscal relations, and threatens the imperfect but enduring agreement that strong states should help weaker states – an agreement that has helped save us from some of the bitter divisions in other federations.

Cost of living to tumble as tariffs removed on tailors’ chalk, kiddies’ tricycles and toasters

The Treasury has announced the abolition of “nuisance tariffs” on around 500 items.

There should be small savings for consumers, not so much from removal of the tariffs themselves, but from savings in compliance costs borne by importers. According to a government press release those costs come to about $30 million a year. There will be some cost to public revenue, but it’s trivial: in fact the government doesn’t seem to have bothered to calculate it – my guestimate is that it will be at most $5 million a year.

The case for eliminating nuisance tariffs was established in a 2020 Productivity Commission research paper The nuisance cost of tatrifs. As pointed out in that paper, over 99 percent of tariff classifications (“statutory tariffs”) are either zero or 5 percent. In fact 90 percent of goods enter Australia duty-free, and the average tariff paid is just under2 percent.

The tariffs we still have are a residual from the Hawke-Keating government’s program of tariff reduction in the 1980s. The only reason we now have any tariffs is to keep them as bargaining chips in trade negotiations. Abolishing tariffs on 500 items costs so little to public revenue because although these goods generally carry a tariff rate of 5 percent, for most transactions the tariff is waived under bilateral trade agreements.

Australia’s path from high tariffs in the postwar years to having tariffs well below the average for high-income countries has been a long one. At the same time as tariffs around the world have fallen, more non-tariff barriers have risen, including copyright and intellectual property protection, national security, and safety standards.

And in the not-too-distant future there will be Carbon Border Adjustment Mechanisms, which act as a carbon price, levied on goods the price of which has not included payment for greenhouse gas externalities. In this sense they are akin to dumping duties, which apply when prices do not include the full cost of production.